Business Climate

State Tax Rates

Business Income Tax

For tax years beginning on or after July 1, 2017

• Corporations – 7 percent of net income

• Trusts and estates – 4.95 percent of net income

Individual Income Tax

For tax years beginning on or after July 1, 2017

• 4.95 percent of net income

Personal Property Replacement Tax

Corporations – (other than S corporations)

• 2.5 percent of net income

Partnerships, trusts, and S corporations

• 1.5 percent of net income

Withholding (payroll)

4.95 percent of net income is required to be withheld from:

• Employee compensation based on the number of allowances claimed by the employee,

• Illinois lottery winnings each time a single payment is over $1,000 for both Illinois residents and nonresidents, and

• Other gambling winnings paid to an Illinois resident if the winnings are subject to federal income tax withholding requirements.

Sales Tax

The state sales tax rate for general merchandise is 6.25% and any amounts added by local municipalities. The City of Kankakee sales tax rate is 8.25%; all other municipalities within Kankakee County levy the state rate.

According to the Tax Foundation, the average sales tax rate in Illinois is 8.64%.

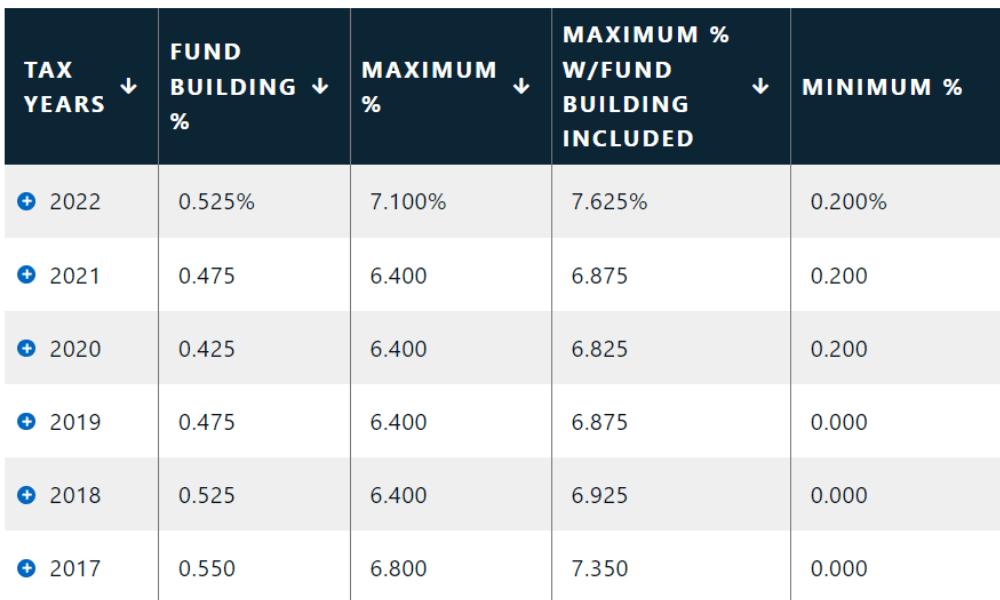

Unemployment Tax

More at Illinois Department of Employment Security

County Business Taxes

Property Taxes

The property tax is the largest single tax in Illinois and is the major source of revenue for local government taxing districts (counties, townships, municipalities, school districts and special taxing districts). Property tax rates in Kankakee County vary by municipality.